- 201 Millway Ave #17, Concord

- support@mortgagesquad.ca

Our experienced mortgage brokers are here to help you secure a home loan in Ontario, even if your credit score isn’t perfect.

We help many people with low credit scores buy their first home. Our team works with you to find good rates and flexible plans that fit your money situation. Over time, we can also help you improve your credit by managing your mortgage carefully.

You can also contact us for help with mortgage refinance, renewal, debt consolidation, HELOC, or self-employed mortgages. We serve people in Scarborough, Ottawa, Newmarket, Oakville, Etobicoke, Vaughan, and nearby areas.

Learn how long bad credit stays on your record and take the right steps to improve it today!

Our team helps people with low credit scores buy their own home. We find good rates and flexible terms that fit your money situation. At the same time, we help you improve your credit over time by managing your mortgage responsibly.

We also help with mortgage refinancing, renewal, debt consolidation, HELOC, and self-employed mortgages. We serve people in Scarborough, Ottawa, Newmarket, Oakville, Etobicoke, Vaughan, and nearby areas.

Take the first step today. Learn how long bad credit stays on your record and start working toward owning your home.

Prime Lenders: These are big banks and well-known financial companies. They usually like people with higher credit scores, but some may give good rates if your score is 600 or higher.

Trust Companies and Bad Credit Lenders: These lenders focus on helping people with lower credit scores. They often work with scores around 700 or lower. Some can even help if your score is as low as 550.

Private Lenders: Private companies or individual investors can give loans to people with very low credit. The interest rates are usually higher than banks or trust companies. But they are a good option if your score is below 600.

If you want to apply for a home loan but your credit score is low, there are some important things to know. Lenders will look carefully at your financial situation. They usually focus on things like:

At Mortgage Squad Advisors, we help people with low or imperfect credit buy a home. We know it can be hard to get a mortgage with a low score, and we have over 15 years of experience helping clients.

We offer pre-qualification and strong support to show your situation in the best way. Our team guides you through every step, making the mortgage process simple, stress-free, and possible, even if your credit isn’t perfect.

In Canada, where a suitable mortgage agreement is challenging, our expert team guides you to make the best deal within your budget. No hidden charges, no stress

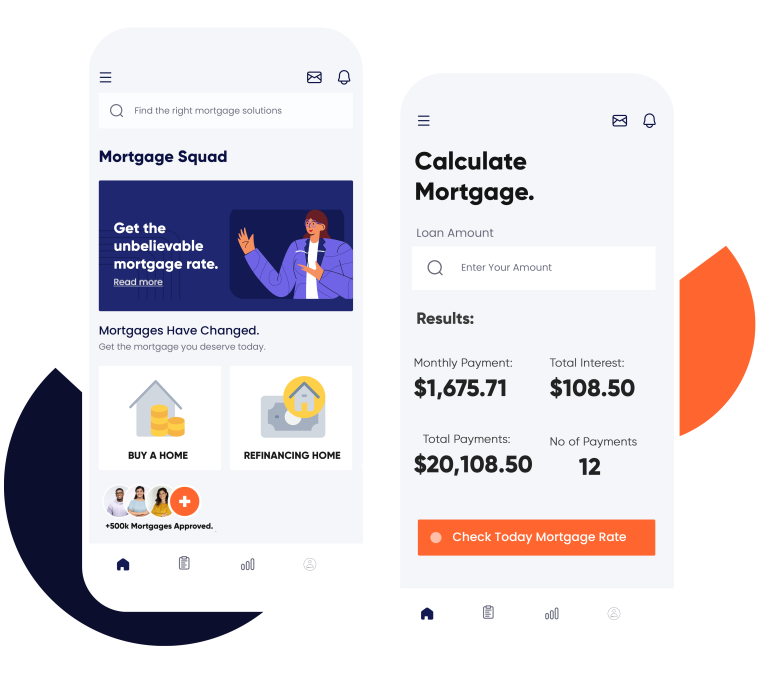

Get ahead of the game. Discover your mortgage potential swiftly and effortlessly.

Are you in the market for a new home? Our VIP Realtor Program offers an exceptional opportunity tailored just for you.

Free Legal Fee Program - A $1000 Value

Yes! A bad credit mortgage broker like Mortgage Squad can connect you with lenders who work with people with low credit scores.

Yes, Even with a low credit score, you may qualify for a bad credit mortgage. Mortgage Squad works with trust companies and alternative lenders to help more people become homeowners.

Many lenders in Canada prefer scores of 600 or higher. But some bad credit lenders accept lower scores. Mortgage Squad can help you find the right option and get approved.